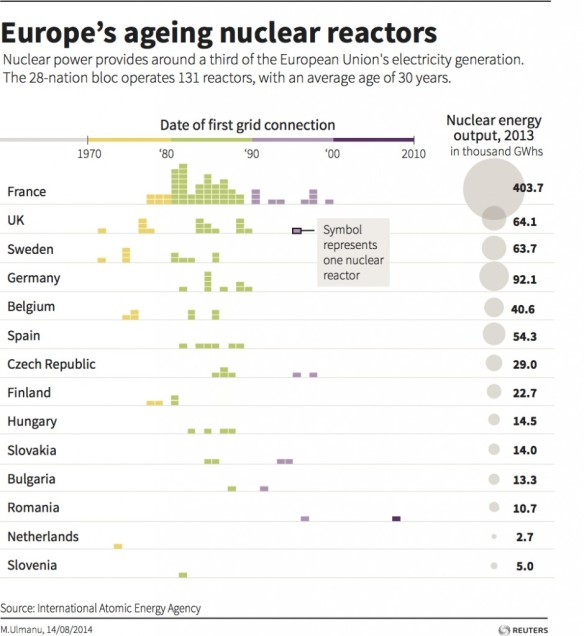

Thomson Reuters made a nice visualisation on Europe’s aging nuclear reactors. Currently the EU operates 131 reactors with an average age of 30 years.

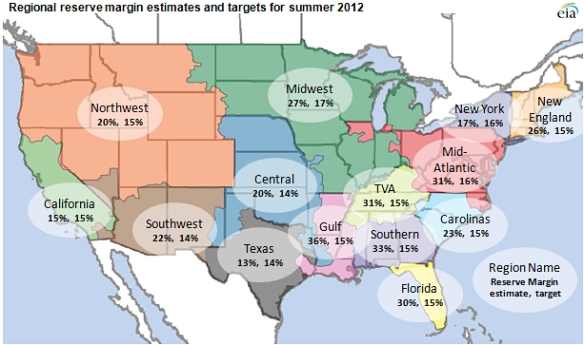

It reminded me on a report I wrote in 2012 for Broadgroup about the power market and data centers in Europe. The quality and availability of the data center stands or falls with the quality and availability of the power supply to the data center. So the power market is something to watch closely.

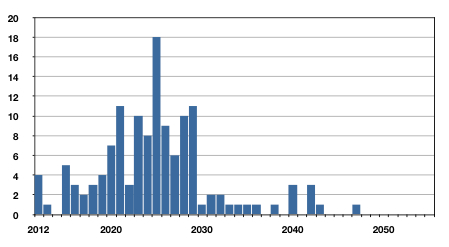

Depending on the power technology that is being used, power plants have different life cycles. Coal-fired plants have a life cycle of about 40 years, gas-fired: 30 years, nuclear: 40 years, hydro: 80 years, and renewables are estimated on 25 years. Based on this life cycle estimates we can say that Europe has an ageing power plant fleet. A report of RWE states that for hard coal power plants more than 70% are in their half of their life cycle, for lignite and gas/oil more than 60% and more than 50% of the plants are in their half of their life cycle. For hard coal plants, based on the EU Large Combustion Plants Directive, replacement of all these plants is needed by 2030.

There is the expectation that the nuclear reactor lifetime is 40 years or more. The implication of a forty-year life expectancy is that in the next ten years (from 2012 onwards) forty nuclear power plants will be closed or 30% of the current nuclear power plant fleet. This would be a decommissioning of 30207 Mw net capacity, or 24.5% of the nuclear power capacity.

Given the fact that the average age of the 130 units that already have been closed worldwide is about 22 years, the projected operational lifetime of 40 year or more appears rather optimistic.

The decommissioning of nuclear power plants, has an impact on the carbon policies and targets and can create a shortage in power and a rise of the electricity price if proper counter measures are not taken.

A special case is Belgium. Two nuclear reactors were closed for a second time in march 2014 because of cracks in the steel reactor casings. The nuclear reactors Doel 3 and Tihange 2 in Belgium will be restarted earliest in the spring of 2015 and there is an increased chance that will be closed forever.

In august another nuclear reactor, Doel 4, has to be shut down after major damage to its turbine because of oil leakage. Electrabel said its Doel 4 nuclear reactor would stay offline at least until the end of this year, with the cause confirmed as sabotage.

As a result of this just over 3 GW of power is offline, more than half of the nuclear power supply. Whereas nuclear power contributes about 50% of the electricity produced domestically.

supply. Whereas nuclear power contributes about 50% of the electricity produced domestically.

So there is the possibility of blackouts this winter so Belgium will have to boost interconnection capacity with neighbouring countries to prevent power shortages.

According to the Minister of Energy Johan Vande Lanotte the last electricity consumption record was recorded on 17 January 2013, “On such a cold winter day, we consume about 14,000 megawatts. With the current production we come 1000 too short.”

Much depends on the weather, potential problems are to be expected from the end of october or early november according to Elia, Belgium’s electricity transmission system operator.

See Power market, power pricing and data centers in Europe. Broadgroup 2012, for more information about the electricity market and data centers in Europe.