This week I attended (and was chair of one of the tracks) of the DatacenterDynamics conference in Amsterdam. This year the conference program set up was along three themes, Design, Build & Operate, Outsourcing Decisions and IT Optimization.

This week I attended (and was chair of one of the tracks) of the DatacenterDynamics conference in Amsterdam. This year the conference program set up was along three themes, Design, Build & Operate, Outsourcing Decisions and IT Optimization.

During the day a wide range of cases and technologies were presented. And at the end of the day there was a grand final with a very interesting panel discussion led by John Abbott, founder & chief Analyst of the 451 Group and Harkeeret Singh (Thomson Ruters/Green Grid), Tom Dowdall (Greenpeace), Hans Timmerman (EMC/EuroCloud Netherlands) and Jan Wiersma (Evo Switch/Data Center Pulse) as participants.

In the beginning some arguments were exchanged about how green cloud computing really is. Soon the focus shifted to a discussion about the relation between the electrical energy infrastructure and the IT infrastructure and how efficient it is to use mega data centers.

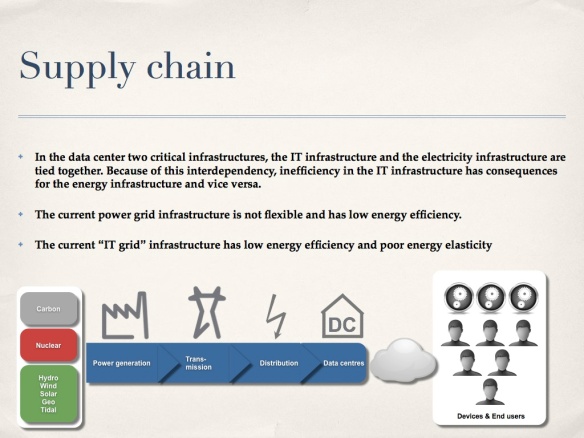

Currently data centers are constructed on the intersection of the electrical energy infrastructure and the network (data) infrastructure. The observation was made that based on technological developments, the principle of economy of scale and the current set up of the electrical energy infrastructure this leads to the building of mega data centers.

This development has also a downside, the example was given that for the city of Amsterdam 10% of the energy consumption is done by data centers, and in the vicinity of airport Schiphol/Amsterdam it is even 25%. The result of this is that there will be energy supply issues for the next decade for the Amsterdam region.

As a side step. In other parts of the world there are even certain critical locations, also known as Critical Areas for Transmission Congestion, were there is insufficient capacity to meet the demand at peak periods (DOE, “National Electric Transmission Congestion Study.”, 2006). And don’t forget that we also have to take into account that the energy loss in the power grid, that is from primary energy source to the actual delivery of electrical power at the data center, is almost 70% (around 67% power plant conversion loss and 8-10% transmission grid loss). Indirect this mega data centers are part of this 70% energy loss in the power grid.

The discussion about the developments in the data center industry at first followed the same line of reasoning as in the book “The Big Switch” by Nicholas Carr.

Carr makes a historical analysis to build the idea that the data centers / Internet is following the same developmental path as electric power did 100 years ago. At that time companies stopped generating their own power and plugged into the newly built electric grid that was fed with electric energy by huge generic power plants. The big switch is between today’s proprietary corporate data centers to what Carr calls the world wide computer, basically the cloud with some huge generic data centers that provides web services that will be as ubiquitous, networked and shared as electricity now is. This modern cloud computing infrastructure is following the same structure as the electricity infrastructure: the plant (data center), transmission network (Internet) and distribution networks (MAN, (W)LAN) to give process power and storage capacity to all kind of end-devices.

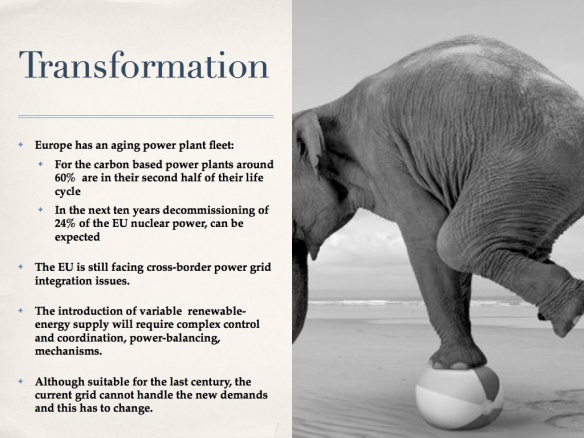

But where Carr stops using this analogy the panel went one step beyond. Here in the panel discussion the comparison was made with current developments in the electrical energy infrastructure: local power generation based on alternative energy sources such as wind and solar energy. Local power generation that, with improvements of the current technology, could even lead to local energy self sufficiency. Using this as an analogy another data center industry development, or next step or next phase, was envisioned.

Thus instead of relying only on centralized mega data centers another solution, another paradigm is possible in the nearby future that is much more focussing on an intelligent distributed network of localized micro data centers who are energy self sufficient.

For the current moment with the trend of consolidation of data centers to mega data centers, based on the thriving force of economy of scale, the emphasis should be made on data center efficiency and the usage of renewable energy. Although the panel revered to the Jevons paradox, increases in the efficiency of using a resource tends to increase the usage of that resource, the statement also was made that we should appreciate that every kilowatt that isn’t used also doesn’t have to be generated. Data center efficiency is not only about energy efficiency it is also about water usage, e-waste handling. The panel agreed that if you talk about efficiency, a holistic (not energy usage only), cradle to cradle approach should be used.

For the current moment with the trend of consolidation of data centers to mega data centers, based on the thriving force of economy of scale, the emphasis should be made on data center efficiency and the usage of renewable energy. Although the panel revered to the Jevons paradox, increases in the efficiency of using a resource tends to increase the usage of that resource, the statement also was made that we should appreciate that every kilowatt that isn’t used also doesn’t have to be generated. Data center efficiency is not only about energy efficiency it is also about water usage, e-waste handling. The panel agreed that if you talk about efficiency, a holistic (not energy usage only), cradle to cradle approach should be used.

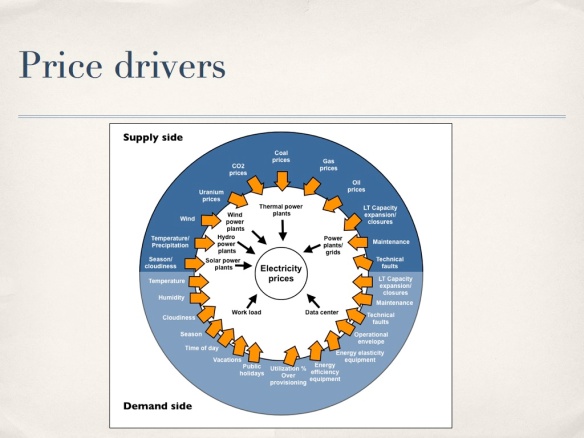

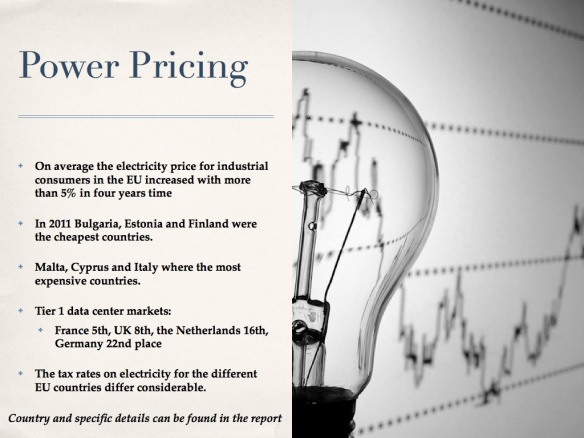

Apart from efficiency improvements, data center providers should also think about how they can reduce carbon emissions by powering data centers from low-carbon electricity sources, such as hydropower or wind energy. The panel discussed the ‘quality’ of the electrical energy that is being used in data centers. How to compare energy efficiency if this efficiency is reached by using nonrenewable energy resources? Currently most of the data centers providers don’t disclose what kind of energy resources they are using. According to the panel one of the issues is that at the current moment there are hardly independent resources about the composition of the electrical energy that is being delivered. It was stated that data center providers could take a much more pro active attitude in this issue by asking the power suppliers to give insight in there energy resource investment policy (renewable/nonrenewable) and take there answers into account when choosing a power supplier for their data centers.

All agreed that sustainability is an import issue for the data center industry. A pro active attitude of the data center industry in combination with a government that step up to support the sustainability initiatives of this industry (by creating the right incentives) can push and accelerate the power suppliers activities on sustainability and usage of renewable energy resources.

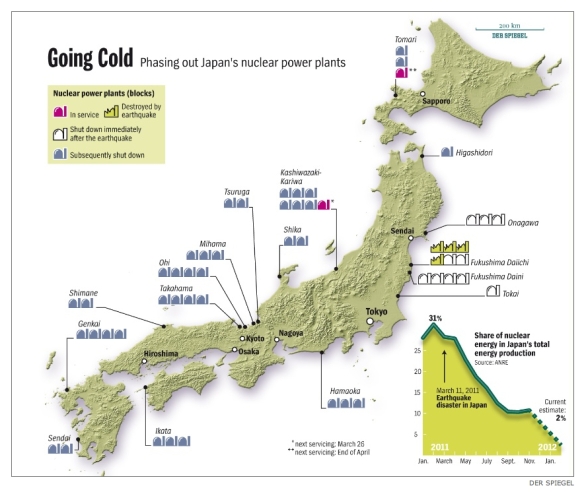

There is a vulnerable relationship between the environment, the power grid and data centers. For example last year in Texas, U.S.A, a state with data centers of several notable IT companies, including WordPress.Com, Cisco, Rackspace and Host Gator, nearly escaped rolling blackouts because of extreme weather conditions. Extreme heat led to extreme electricity demand for cooling equipment and the extreme drought led to production problems for the power generators because of shortage of cooling water. And this is not the only example. During recent warm, dry summers in 2003, 2006 and 2009 several thermoelectric power plants in Europe were forced to reduce production, because of restricted availability of cooling water.

There is a vulnerable relationship between the environment, the power grid and data centers. For example last year in Texas, U.S.A, a state with data centers of several notable IT companies, including WordPress.Com, Cisco, Rackspace and Host Gator, nearly escaped rolling blackouts because of extreme weather conditions. Extreme heat led to extreme electricity demand for cooling equipment and the extreme drought led to production problems for the power generators because of shortage of cooling water. And this is not the only example. During recent warm, dry summers in 2003, 2006 and 2009 several thermoelectric power plants in Europe were forced to reduce production, because of restricted availability of cooling water.